While cooperative housing, also known as co-ops, closely resembles condominiums, this type of property functions in a unique way. Here are all the ins and outs of cooperatives.

What is Cooperative Housing?

Cooperative housing provide multiple units in a single building which often offers residents common shared space similarly to condos. However, instead of purchasing title to the property, buyers acquire shares into a corporation that owns the building.

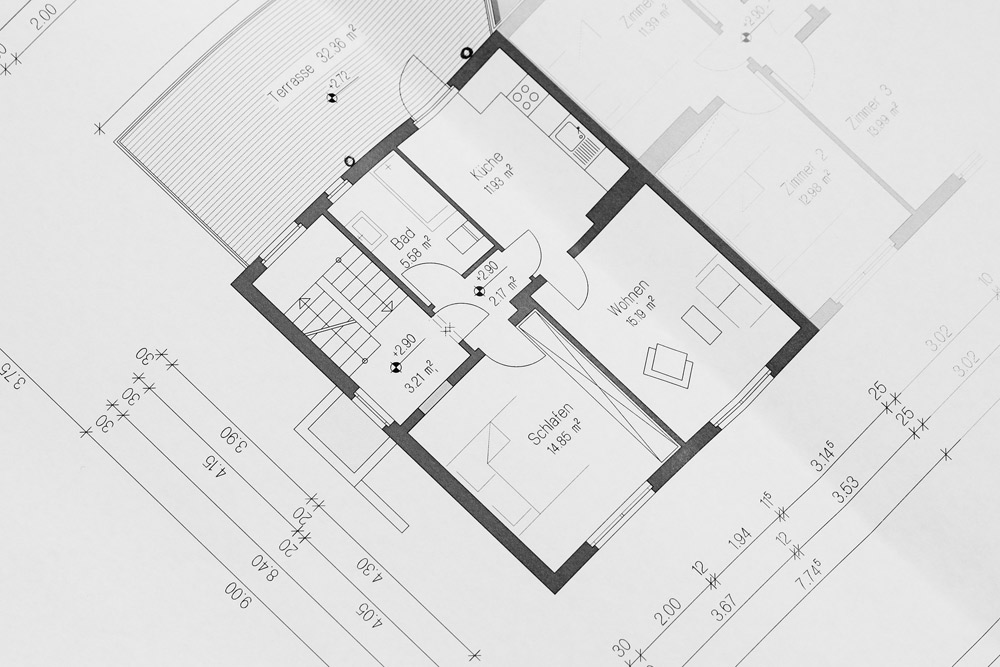

Co-ops often feature old historic buildings, boasting stunning architecture, unbeatable character and unique floor plans in each unit.

Residents may get a few units on each floor or even multiple stories. Generally, the larger the apartment, the more shares the buyer must purchase.

How do you Get into a Co-op Building?

When it comes to obtaining cooperative housing, buyers should know that it is a more restrictive process than condo purchases for a few reasons.

While cooperative housing allows financing, there are many more limits in place compared to condo purchases. Also, current co-op shareholders often have a say in who moves in the building.

Buyers often must go through an approval process to make sure they can afford their share of the building. This process frequently involves an application, a detailed balance sheet, and several personal and professional letters of reference. Some co-ops also request to see tax returns. Once the co-op board has received and reviewed the buyer’s application, an interview is scheduled, and then the buyer may be officially approved.

When homeowners are ready to leave a co-op, instead of selling the unit, he or she must resell their shares in the co-op. Depending on the housing cooperative, the shareholder may have to sell the stock back to the corporation at the original purchase price. Then when the corporation finds a new buyer for the unit, the profit is divided and distributed among all of the co-op shareholders. In other co-ops, the original shareholder may get to keep the profits.

When reselling co-op shares, the process of approval for a new shareholder looks identical.

Is there any resale value?

Since the primary benefit of buying shares to a co-op is a better value for your space, it is not an ideal property for an investment or profiting after a resale.

Cooperatives promote long-term residency, as opposed to many condominium buildings.This is why buyers are discouraged or prohibited from leasing or flipping the unit for investment.

Oftentimes, when co-op residents are ready to move, they are required to sell their shares back to the corporation for the original purchase price, with all of the shareholders collectively sharing the profit once the the shares are resold. In other cases the shareholder moving will get to keep the profit.

If you are a prospective buyers looking for a home that provides charming character, great value, and a sense of community, find an experienced broker and begin the search for the perfect cooperative housing today!